Hello Traders !

We all know that one of the Key Factors to success on any Setup is the Money Management.

So we decided to upgrade all our PMS Semi/Full Auto Systems adding this feature.

Even being the PMS's Systems originally focused to Manual Trading with Automatic Assisted Entry, when we trade several setups at the same time, it turns complicated to keep track each Setup Performance.

On the following Picture we can see Both New Input Parameters :

If current Daily Profit or Daily Loss exceeds those input parameters. no more orders will be issued by the rest of the session, or until the user change the parameters.

Example with a Daily Limit Profit of $500

Another additional feature asked by several traders is the Delayed Entry Order Cancellation.

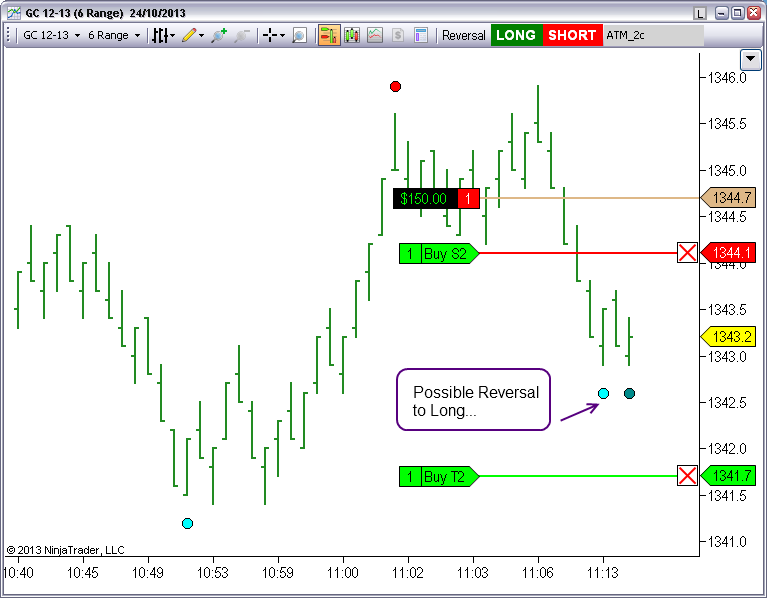

On this YouTube video we can see the New PMS_Reversal in Action :

On the following days, the rest of the PMS Systems ; EMA, SRS will include the Money Management Feature. Stay tuned for more Features !

If you are a current user of the PMS_Reversal, log into your account to download the last version.

Best Regards,

Pablo